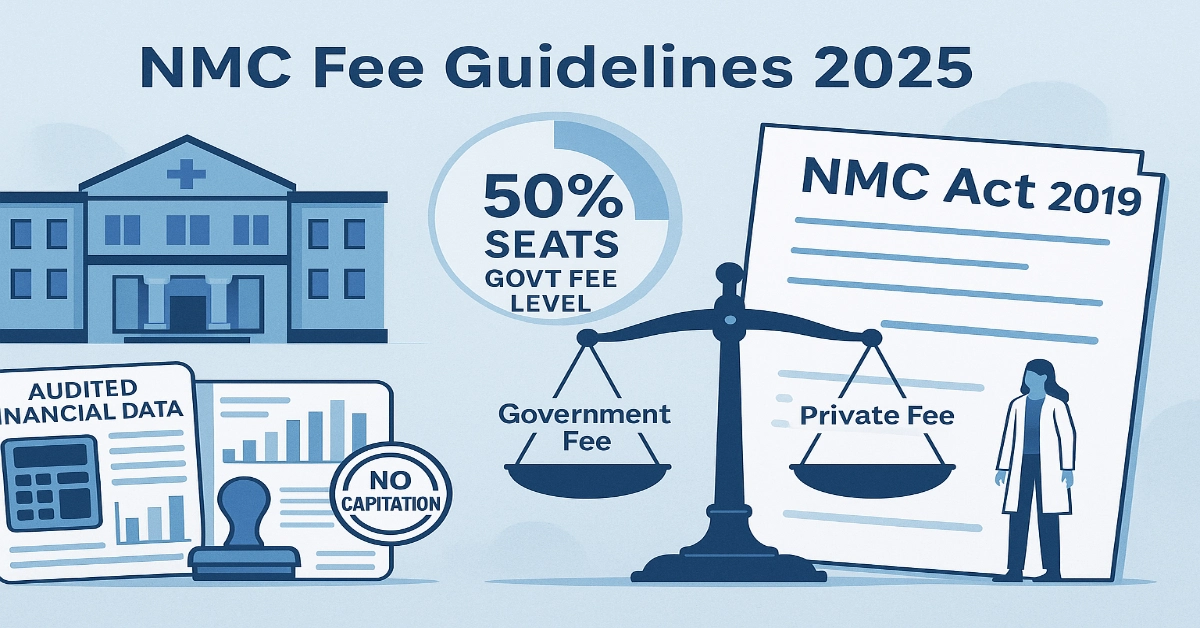

NMC Fee Guidelines: The purpose of the National Medical Commission (NMC) was to bring reforms in India’s medical education system. In this direction, one of its important provisions, Section 10(1)(i), mandates the NMC to frame guidelines for the determination of fees and other charges for 50% of seats in private medical colleges and deemed universities governed under the NMC Act 2019.

This fee regulation is aimed at ensuring transparency, affordability, and standardisation, especially for meritorious students wanting MBBS and Postgraduate (PG) medical education.

But in reality, these regulations have not been implemented. Private medical colleges have resisted the fee caps, leading to legal battles and resisting enforcement.

NMC Fee Guidelines: Background and Objective

To implement Section 10(1)(i), the Central Government directed the then Board of Governors (BoG) of the Medical Council of India (MCI) to draft the NMC Fee Guidelines. An Expert Committee was formed by the BoG on 23rd November 2019, and subsequently by the NMC.

NMC Act 2019 Chapter II Section 10 – Powers and functions of Commission

Article 1: The Commission shall perform the following functions, namely:

Clause i: frame guidelines for the determination of fees and all other charges in respect of fifty per cent. of seats in private medical institutions and deemed to be universities, which are governed under the provisions of this Act;

The National Medical Commission Act 2019 empowers to bring change and implement provisions for better change in medical education in India.

After reviewing approximately 1,800 public responses, the NMC finalised and accepted revised guidelines on December 29, 2021.

The goal: make 50% of the seats in private medical institutions affordable, with fees at par with government medical colleges in respective States and Union Territories.

NMC Fee Guidelines: Key Points

No Capitation Fees

Capitation in any form is strictly prohibited. Institutions found violating this are liable for regulatory and legal action.

Fees Based on Operating Costs

Fees should reflect genuine operational expenses and must adhere to the non-profit ethos of education. Components include:

- Salaries of teaching/non-teaching staff

- Lab maintenance

- Administrative costs

- Infrastructure upkeep

- Library resources

- Amortised capital expenditure

Use of Audited Financial Data

Fee determination should rely on audited accounts, preferably for the past three years. In the absence of such data (e.g., newly established colleges), fees may be set ad hoc based on peer institutions.

Fee Parity with Government Colleges

Candidates availing government quota seats (up to 50% of the sanctioned intake) in private colleges will pay fees equivalent to government medical colleges. If the government quota seats are fewer, the remaining seats will be allotted this benefit based on merit.

Read Also: NMC vs Private Colleges on Fee Guidelines 2025: Rising Medical Education Cost Crisis

Key Principles for NMC Fee Guidelines

Transparent Segmentation of Expenses

- Institutions must follow Ind AS 108 for segment reporting

- It will clearly outline costs for academics, hospital, hostel, and auxiliary services.

Ind AS 108: Operating Segments: Educational Institutes

- Applicability: Applies only to large institutes following Ind AS (e.g., listed or with net worth ≥ ₹250 crore).

- Segment Definition: Segments can be by faculty (e.g., Engineering, Medicine), campus, or funding type.

- Required Disclosures: Must disclose segment-wise revenue, profit/loss, and assets if reviewed internally.

- Based on Internal Reports: Reporting mirrors how management (CODM) monitors performance internally.

- Additional Metrics: Non-financial data (like student numbers or pass rates) may support segment insights, though not mandatory.

Selective Inclusion of Hospital Costs

- Only a justifiable portion of hospital costs used for education may be considered.

- For loss-making hospitals in underdeveloped areas, up to 20% of hospital costs can be included temporarily (5-7 years max).

Staff Salaries and Ratios

- Full salaries of clinical teaching staff (engaged in hospitals) are counted.

- Stipends for interns and PG students are considered hospital costs.

- TRACE reports may be used for salary verification.

TRACE Reports for Salary Verification:

- TRACE (via Form 16/26AS) shows salary paid and TDS deducted by the employer.

- Used for salary verification in loans, visas, and background checks.

- Data is authentic and tamper-proof, sourced from the Income Tax Department.

- Helps match the income reported by the employee and the employer.

- Accessible via the Income Tax portal under the TRACES section.

Depreciation & Interest

- Depreciation must be consistent and applicable only to used assets.

- Interest on loans is only admissible if from scheduled banks and used directly for the institution.

NMC Fee Guidelines for Other Costs

Grants and Donations

- Revenue grants lower the fee burden.

- Corpus donations and assets purchased via grants are excluded from the fee calculation.

Security Deposits

- Refundable deposits must be reasonable.

- Interest earned should reduce operating costs, not inflate them.

Postgraduate Course Fees

Fees should reflect:

- Direct course-specific costs

- Shared infrastructure and staffing costs

- A reasonable portion of hospital usage

- PG stipends are treated as hospital costs

Read Also: Monopoly in Medical Education in India: Ownership, Costs & Reforms 2025

Development and Ancillary Fees

Development Fee

A 6%-15% margin may be added for institutional growth, based on:

- Past development (5-10 years)

- Future expansion plans

- Performance ratings (proposed NMC mechanism)

Optional Facilities

Hostel, mess, transport, and library charges should:

- Reflect actual usage-based costs

- Be optional and transparent

- Stay within fair market rental values

NMC Fee Guidelines: Implementation Framework

State-Level Flexibility

- Fee structures may be fixed college-wise or uniformly within a state.

- A consensus-based median band can be used where appropriate.

Uniform Guidelines for Deemed Universities

The same norms apply to deemed universities as to private colleges, ensuring uniformity.

Mandatory Disclosure

Colleges must publish:

- Audited accounts

- Faculty details

- Hospital and hostel expenses

- Miscellaneous charges

The NMC’s fee determination guidelines suggest a shift towards affordable, fair, and accountable medical education in India. By aligning 50% of private medical seats with government college fees and regulating remaining fees through transparent, cost-based evaluation, the NMC ensures that merit and equity will brighten the future of India’s healthcare education.

These guidelines also empower State Fee Regulatory Authorities (FRCs) to monitor and fine-tune college fees, ensuring that students are not burdened by excessive or unjustified costs while maintaining the financial sustainability of quality medical institutions.

Fee Regulatory Authorities (FRCs) are established by state governments to regulate and determine the fees charged by private unaided professional educational institutions. These authorities aim to ensure fair and reasonable fee structures for students and prevent capitation fees or exorbitant charges.

Frequently Asked Questions (FAQs)

Who benefits from the rule of 50% seats at government fee levels?

The benefit is given to students admitted under the general quota, especially those with lower financial resources, as they can pursue MBBS at much lower costs compared to the earlier private fee structure.

What do the NMC fee guidelines say about private medical colleges?

As per the latest rules, half of the total seats in private medical colleges and deemed universities must charge the same tuition fee as the government medical colleges of that state.

How is the fee decided for these 50% seats?

The tuition fee for these seats is aligned with the government medical college fee of that particular state, which is usually much lower than private tuition fees.

Do these guidelines apply to both private and deemed medical universities?

Yes, the rule is applicable to all private medical colleges and deemed universities across India.

Are hostel and other charges also reduced under this rule?

No, the guidelines are specific to tuition fees. Other charges like hostel, mess, and miscellaneous fees are decided by the college separately.

How many students benefit from this decision in each private medical college?

Approximately 50% of the total intake in each private institution gets the benefit of government-level tuition fees.

Very nice information

Thanks for being here. Keep visiting for latest and updated NEET News.

Title is misleading. Please read the NMC Act provision stated in the article.

This is NMC guideline, which colleges have to implement as stated in NMC Act 2019. But without any legal penalty backing, medical colleges are resisting. We have have some state who are implementing it strictly. For example Bihar Private MBBS Colleges Implement 50% Govt-Fee Rule.