PM Vidyalaxmi Scheme: The National Medical Commission (NMC) has ordered that 50 top medical colleges add information about the PM Vidyalaxmi education loan scheme in their prospectuses and admission brochures. The directive, which focuses on better access to funds for meritorious students, highlights the government’s efforts to provide collateral-free, guarantor-free, and transparent education loans to deserving medical aspirants.

NMC Issues Public Notice to 50 Top Medical Colleges

The National Medical Council (NMC) released a public notice on 15 June ordering 50 top medical colleges to add information about the PM Vidyalaxmi education loan scheme in their prospectuses and admission brochures.

Note: You can download the complete list of 50 medical colleges.

What Is the PM Vidyalaxmi Loan Scheme?

Launched on November 6, 2024, under the umbrella of the Model Education Loan Scheme (MELS) by the Indian Banks’ Association (IBA), the PM Vidyalaxmi initiative enables students at Quality Higher Education Institutions (QHEIs) to secure:

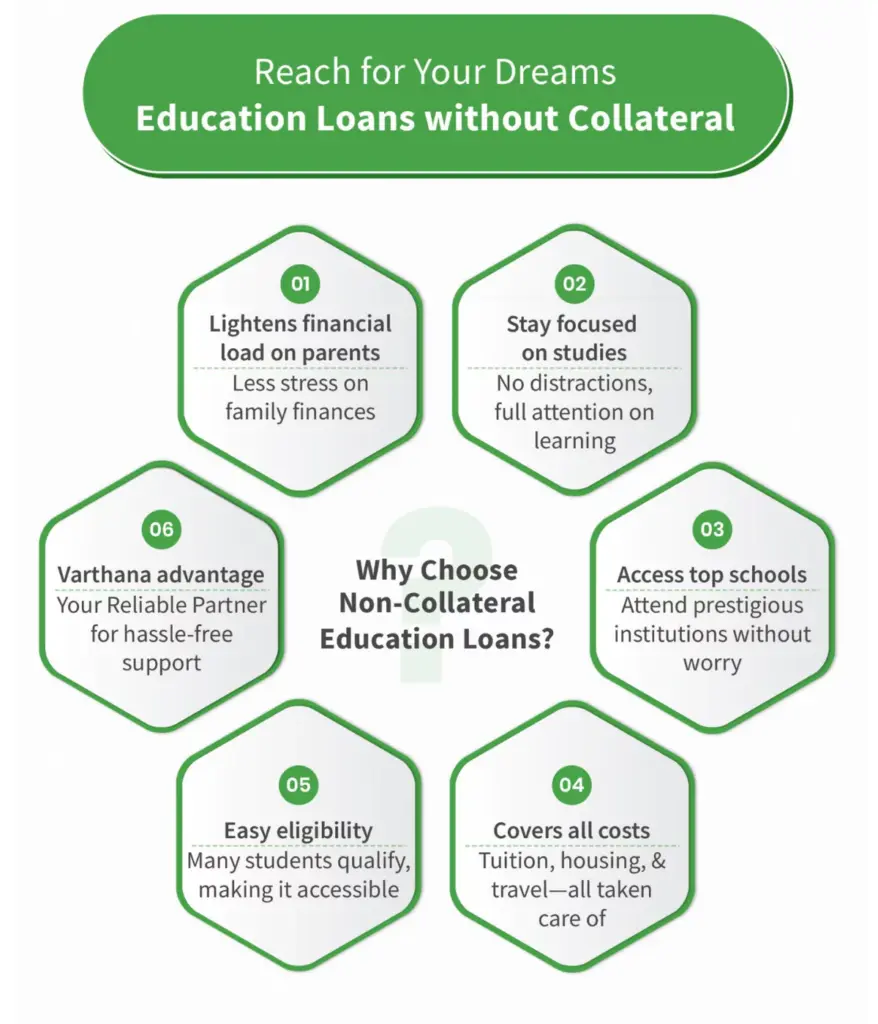

- Up to ₹10 lakh as an education loan

- No collateral or guarantor required

- 75% credit guarantee on loans up to ₹7.5 lakh

- Interest subvention of 3% for students whose family income is up to ₹8 lakh annually

- Entirely digital, student-friendly application experience

Key Highlights of the Scheme

- 82 banks are linked to the portal, including public, private, regional rural, and cooperative banks.

- Over 860 higher education institutions (HEIs) registered for hassle-free verification.

- Provision of unsecured loans (without collateral/guarantor) for students of these institutions.

- Digital processing via the PM Vidyalakshmi App reduces manual paperwork.

- Interest subsidy for economically weaker sections.

Incremental Increase in Education Loan and Expenses Covered

Which Institutions Are Covered?

The NMC’s directive spans 50 premier medical colleges, including:

- AIIMS campuses (Delhi, Mangalagiri, Guwahati, Patna, etc.)

- PGIMER Chandigarh, NIMHANS, JIPMER Puducherry

- Leading state-run and private institutions such as CMC Vellore, AFMC Pune, Kasturba Medical College (Manipal & Mangalore), SGPGI Lucknow, Osmania Medical College, and others.

Eligibility & Key Features for Students

Unsecured Loans up to ₹16 lakh are available for students enrolled in any of the 860 Quality Higher Education Institutions (QHEIs).

Complete digital processing: Loan applications, verification, sanction, and disbursal will be done via the PM Vidyalakshmi App linked to the student’s Aadhaar-verified mobile number.

Interest Subsidy for Economically Weaker Sections:

- Families earning less than ₹8 lakh annually are eligible for a 3% interest subsidy for loan amounts up to ₹10 lakh.

- Full interest exemption for students with family income below ₹4.5 lakh, provided they pursue professional and technical courses recognised by the respective regulatory bodies.

No upper limit for loan guarantees, although interest subsidy applies only up to ₹10 lakh.

Students must use the loan for legitimate expenses, including tuition fees, hostel charges, food, books, a laptop, and miscellaneous expenses.

Find Here: Loans & Scholarships for Medical Education

Financial Transparency in Education Loans

Benefits of Collateral-Free Education Loan

NMC emphasises that all scheduled commercial banks should comply with MELS guidelines and ensure transparent loan disbursement through PM Vidyalaxmi.

What It Means for Medical Students

- NMC’s notice went out on June 15, 2025, with colleges directed to include the loan scheme details in 2025–26 prospectuses.

- Eligible students can apply via the PM Vidyalaxmi portal or through their college-provided information channels.

- Meritorious students at top colleges can now avail loans effortlessly for tuition and living expenses.

- No collateral barriers make high-quality medical education accessible even to families with limited assets.

- Digital process enhances speed and efficiency—no more long waits at bank branches.

By institutionalising access to PM Vidyalaxmi education loans, the NMC has taken a major step toward financial inclusivity in medical education. This initiative not only eases financial burdens but also promotes transparency and equal opportunity for India’s future doctors.